INTRODUCTION

In this post Alex Ginsburg, senior specialist with more than 25 years of experience in the field of modularization and configuration, will share his personal experience when going out on the hunt for a new vacuum cleaner and the frustration he as a customer experienced. Alex will summarize his findings and what we can learn from these companies to improve their customer experience with well-designed product configurators and guided selling techniques.

Understanding Customer Needs

I have been working with product development all my adult life – more than 25 years. All good products stem from a profound understanding of customer needs. To develop a perfect product, a company needs to know where, how, when, why, how often the product is used, cleaned, maintained, stored, etc.

There are multiple tools and methods to capture customer needs and translate them to specifications containing functions, features and performance levels of the product. Few companies use these methods in a consistent and structured fashion, but most still manage to develop tacit knowledge within their product development teams. To a smaller extent they develop organizational structured knowledge in the form of target segmentation models with customer personas, check lists and other assets. Therefore, most companies have, if not great, at least an acceptable knowledge about their customers’ needs and have the capability to translate them into some form of product specifications.

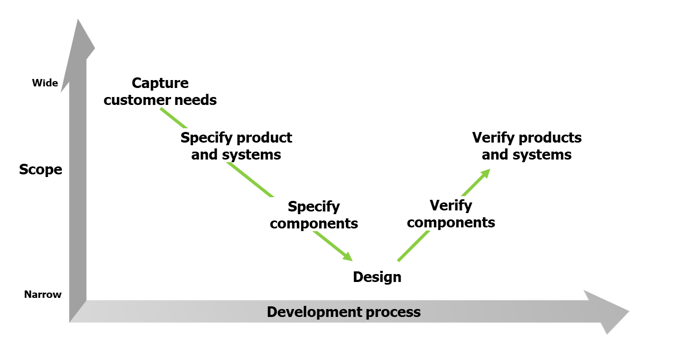

The process from specification-to-design is often the more consistent and structured. There are documented methods in how to break-down specifications from systems to components and how to calculate, simulate and test to make sure specifications are met.

If the product and system level specification is well done, a development team only needs to verify against this specification. They don’t need to verify against the actual customer needs. An example is the customer requirement that the product must be portable. There is a clear specification for the max weight, the max distance of center of gravity from the body of the person carrying the product, the shape and material of the handle and the max height from product base to the handle. If the development team meets these specifications the product should be portable.

If I am a professional, repetitive buyer of a certain product I have probably gained enough knowledge and experience with the product to be interested in many of the details of a very technical specification. But when I’m a one-time, novice buyer of a certain product, those details are meaningless to me. I have at least some idea about how I will use the product. I know if I want it to be easily portable. But if learn that it has an Ergo-handle covered with Tri-flex rubber and if the center of gravity is 30 cm from my body when carrying, it doesn’t help me make a decision.

So, how come many companies are fairly successful in developing products that are fulfilling customer needs, but they are terribly bad in guiding the buyer in the purchasing situation. How come they are throwing a lot of mainly meaningless specification values, technical terms, internal brand and model names at us. Why not ask me about what I need and present the best match?

My plan is to share both my and my colleagues’ experiences, knowledge and observations related to needs-based selling, also referred to as guided selling. I will start with my experience when buying a vacuum cleaner, but I will also discuss some more complex and industrial products. So here we go…

Example 1: The Customer Experience Buying a Vacuum Cleaner

I will start by sharing a recent personal experience when buying a new vacuum cleaner for my home. Although I actually participated in developing a new vacuum cleaner platform long time ago, I have mostly forgotten the details. Therefore, I am considering myself a regular vacuum cleaner buyer. I know the where, why and how I need to vacuum, but I am not very interested in special vacuum cleaner features or technical specifications.

My family has two vacuum cleaners. The first one is always “on display” in the kitchen to be easily at hand. It is used several times a day for small jobs. Most importantly, with this vacuum cleaner, is that it needs to look nice. An ugly product “on display” would drive me nuts. Secondly, it needs to be light and easy-to-use. It doesn’t need any exceptional high performance, and I only expect it to last 3-4 years. It definitely should not be expensive. Since it used frequently and has a short expected lifetime, the environmental aspects such as power consumption and material selections are also important to me.

The second vacuum cleaner, which this story is about, is the bigger one used every second week. It is used to vacuum the entire house and to do the occasional “big, dirty jobs” like cleaning the cars. I have destroyed one of these vacuums by cleaning the dust after having plastered a room. The last one was destroyed when my kids used it to clean an outdoor sofa from leaves. They reasoned that there could be big spiders among the leaves, and after completing the job, they left it outside in a heavy rain – game over again.

Consequently, my top priority for a replacement vacuum cleaner is that it is sturdy. At the same time, I absolutely don’t want it “on display”. It must fit into my rather narrow cleaning cupboard, preferably without half of it falling out every time I open the door. I don’t have any indoor pets and my family does not have allergies, so a normal level of cleaning performance is enough. Absolutely no extra rotating brushes or wet cleaning is necessary and, in my impression, will only jam and break down. Since it is used infrequently and I expect it to last at least 15-20 years, the previous environmental aspects and price are of less concern.

I am thinking something sturdy, half-industrial, like Nilfisk , but it must be a different form factor to be stored in my small closet. I’m not planning to rebuild the closet for a vacuum cleaner.

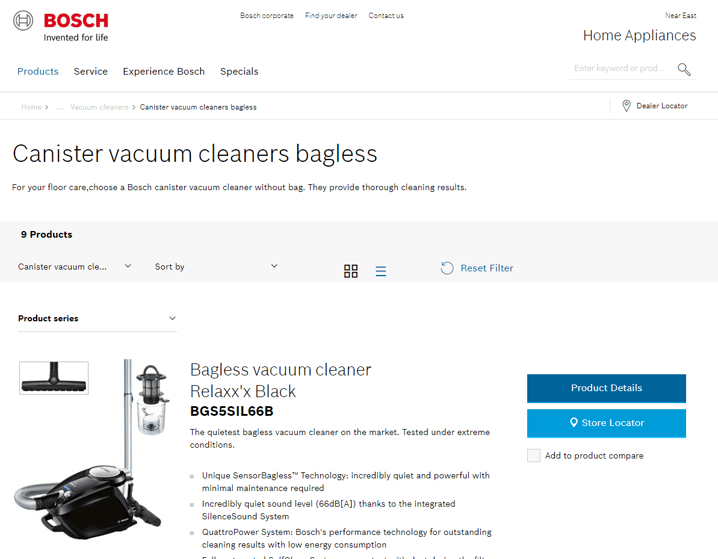

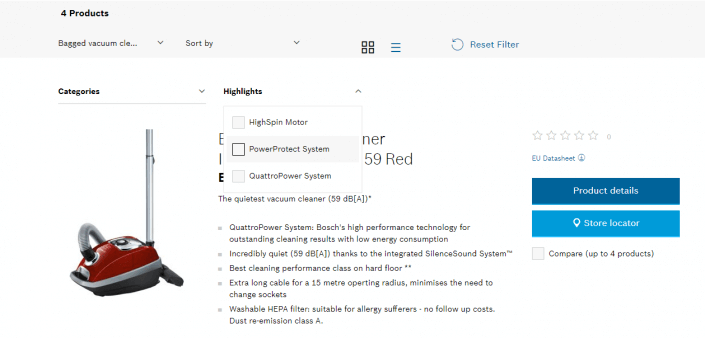

I started to look around the internet, and almost all vacuum cleaner manufacturers had the same approach. I have included images below from the Bosch webpage as an example. On the landing page, Bosch starts with heavy marketing of some features and innovations that do not match what I need. I start by selecting a type of vacuum cleaner and model, often with some possibility to filter on some pre-selected features or specification values such as “HighSpin motor” or cord length. I am presented with a list of model names with some images, highlights and the specifications.

Some of these models could be a good match for me, maybe not. The issue here is that I really don’t know. What I am sure of is that none of the models presented spoke to me or my needs.

Picture from Bosch home page.

Example 2: When Product Configurators are Empowered with Guided Selling

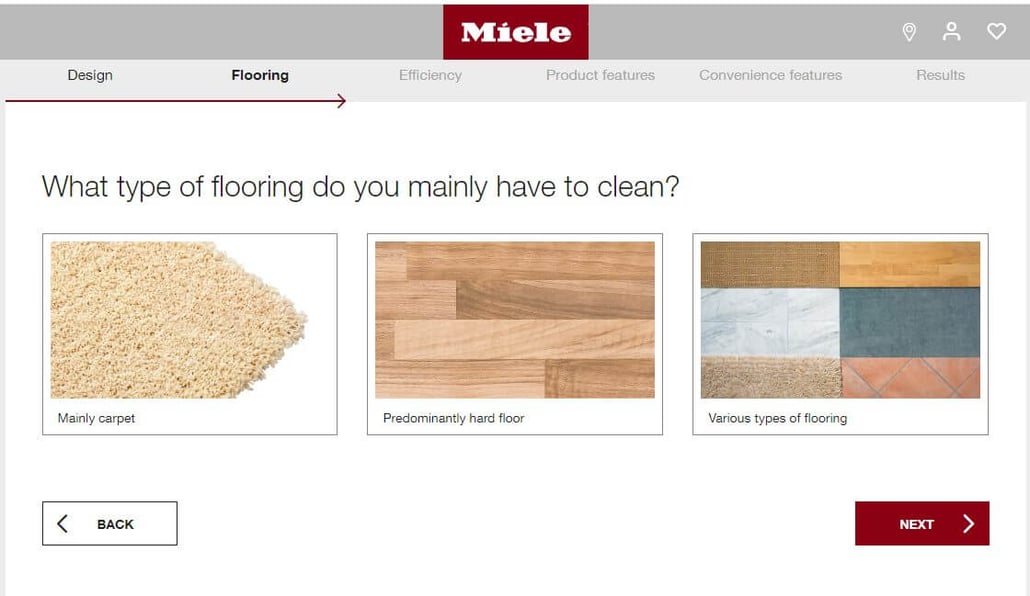

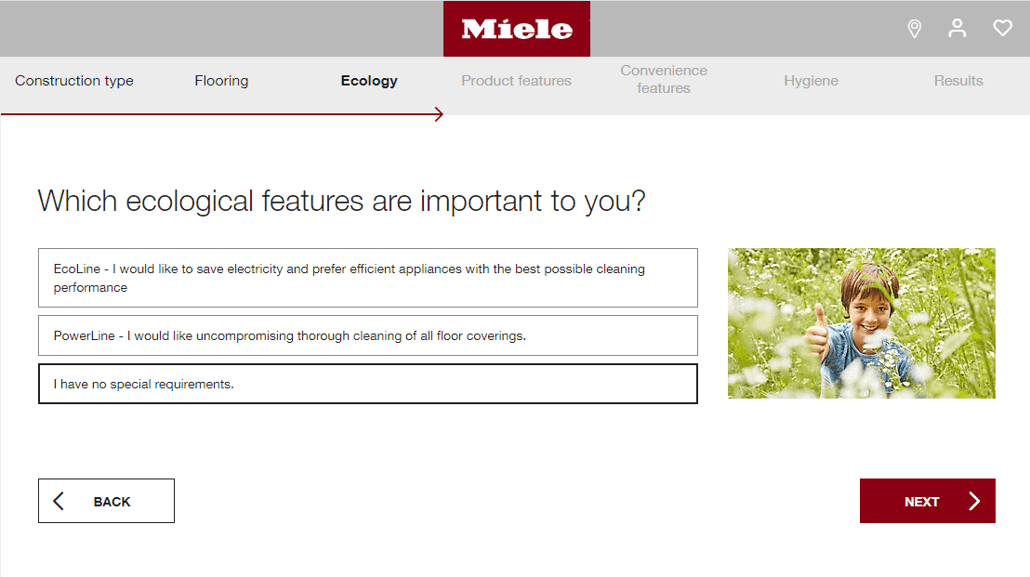

Out of the maybe 15 manufacturers that I looked at, Miele was the only one taking a different approach. At the start I was asked the same questions about the type of vacuum cleaner – canister with bag, bagless, upright… Afterwards, I was asked how I will use the vacuum cleaner and about some of my priorities.

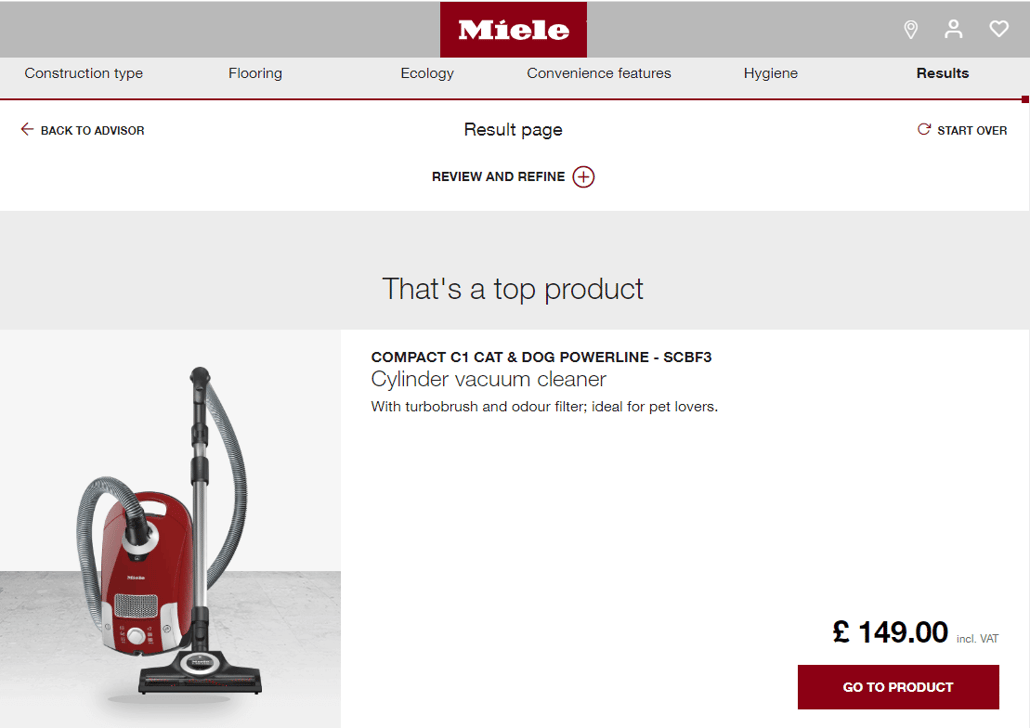

At the end, I was presented with my best match (I was laughing out loud): Compact C1 Cat and dog powerline with turbo-brush and odor filter.

Pictures from Miele home page

Miele has by far the best needs-based selection tool of all the brands I looked at. They approach guided selling in a very nice and easy-to-use manner. Unfortunately, they don’t have a product that fits my needs. I’m thinking that they have made a strategic decision to target specific segments and applications that do not include me. I fully understand that a company will not be excellent if they try to be everything to everyone.

But I was curious, so I went back and changed some of my selections. I found that my changes didn’t affect the result. I went back again and changed my selections in a more random way. It seemed that behind the nice customer-facing tool, they only have a very narrow and rigid product range. By narrow, I mean there are a few basic models to select between. By rigid, I mean that there are few possibilities to add or remove features and options per basic model.

5 Insights to Improve Guided Selling Together With Your Product Configurator

I liked Miele’s front-end, but I left disappointed with their product offering. And, when I thought about it, Miele didn’t learn anything from my interaction. They can probably track my visit, making a first set of selections followed by back-and-forth changes in more and more random ways. I don’t see how they can’t possibly guess why I left without purchasing a vacuum cleaner. They missed the opportunity for free and truly honest buyer feedback.

I would conclude my vacuum cleaner purchasing experience with these 5 insights;

- Make it easy to find the right product by explicitly asking customers about their known needs and then present the best match.

- Also target unknown needs by asking broader questions about how, when, where, why, how often the product is used. For example, I might have discovered that I needed a waterproof vacuum cleaner that can be forgotten outside in the rain. I never would have thought of something like that before writing this post.

- Don’t be afraid to ask questions even if there is a risk of not having an answers today. If buyers are asking for combinations that don’t match today’s products, the information can feed into new product development, helping to develop a better and more flexible future product range.

- Have one entry point for all interchangeable products. With interchangeable, I mean that they have the same basic function and a customer could replace one with the other. In the vacuum cleaner example, I don’t care if the vacuum cleaner is canister with bag or bagless. That is an annoying, irrelevant selection to me. I want the best match from all types.

- Finally, balance the above recommendations on asking more and wider questions with simplicity for the user. Personally, I would never spend the time to answer hundreds of questions. The solution is to expand to more detailed selections in areas of potential high interest, but the expansion into more detail must be voluntary. I would happily answer a series of questions related to max storing dimensions, because I was trying to make sure the new vacuum cleaner would fit into my small cleaning closet. On the other hand, many other buyers probably wouldn’t care and would find these questions annoying.

Scania as an Example on Guided Selling in Complex Product Configurators

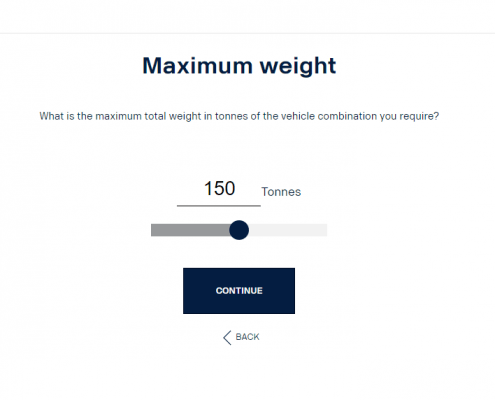

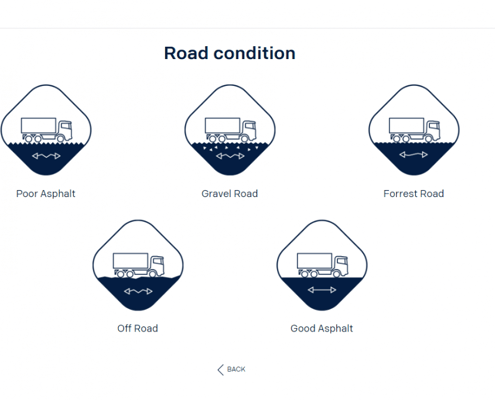

I will finalize this post by giving a good example of guided selling for a more complex product: Scania trucks. Scania’s configurator is not applying 100% perfect guided selling, they do have some steps in the configurator where you need some expertise to select items like wheel configuration. I guess most truck buyers would know what they want here. But Scania’s main approach is very good. They don’t ask to select a model or specification values such as a motor type or size. They ask how the truck will be used. For example, there are questions about max load and the type of roads the truck will travel. Based on these answers Scania proposes a complete product configuration including the correct motor size. Every truck they deliver is unique to meet a customer’s specific needs.

Try it yourself at Scania's home page

Try it yourself at Scania's home page

The Strongest Combination: When Customer Needs Match an Available Product Configuration

By far, the strongest combination is both a good front-end with easy-to-use guided selling and a truly configurable product that meets different customer needs with a perfectly matched offering.

There are two fundamental ways to get started:

- The Miele “front-end” way that starts directly with guiding a customer to the best matching product. In some cases, the product assortment and product flexibility doesn’t allow a good match with a customer’s needs. But please make sure to think about how you can learn and improve the matching over time. If you are interested in all aspects of Mass Customization, you should read our blog on Product Configuration, covering the Product Design, Information System and Supply Chain aspects of truly fulfilling unique customer needs.

- The Scania “back-bone” way that starts with a modular product, documented and handled in the IT-systems for easy mix and match and assembly on a flexible line for each customer order. Scania’s modularity has been one of their most valuable assets for decades, but it is only in recent years that they have started to offer their product range through guided selling.

Summary

To summarize, product managers, sales managers and sales reps should start by thinking about the principles used in selling a product. Is the product pushed to customers, or are the needs of customers pulled to align and propose the right solution? For a deep dive into the area of Need Based Selling you can download my 15 min video here below.

AUTHOR

AUTHOR