Global Modular Systems To Boosted Market Share

Inspiration for Hardware Design

Photo: Blekinge Läns Tidning

Case Story

Dynapac Construction Equipment

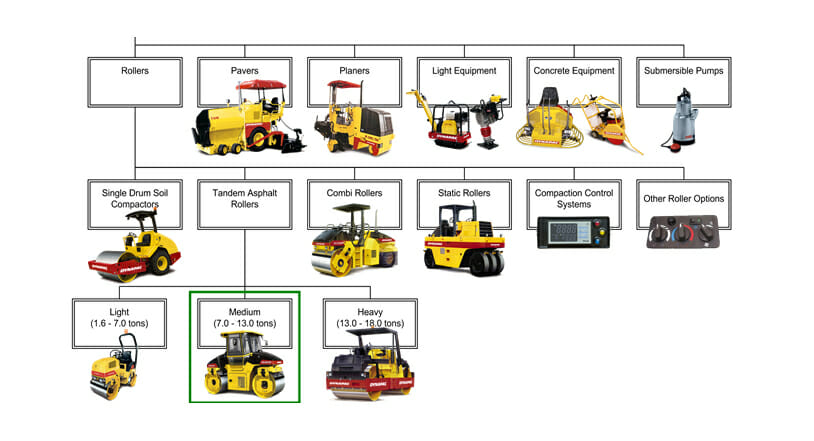

Dynapac’s Product Family Tree for Rollers

Dynapac’s paving equipment faced a number of challenges, including lower profitability, increasing product variety, growing geographic reach, scale inefficiencies, decentralized product development, new emerging markets in Asia.

By 2005, the building of roads in China and other developing countries was the single, most significant market opportunity for Dynapac to grow sales of their products. Although local manufacturers could produce the same types of equipment, products from Dynapac and the other global competitors were more durable, produced a better road surface, and were more efficient. The lower cost of operation justified the purchase of the more expensive machines up to a price point that was slightly less than what could be supported in developed countries.

The challenge for Dynapac and its competitors was to produce products for these developing regions at the right price and performance level. To make a profit, they needed to manufacturer locally including the assembly of final products and the sourcing of components. Besides meeting cost targets, local operations were important for addressing local construction applications that required customization of the existing line of products.

This was not an easy proposition for Dynapac whose operations were already split between several independently-operating companies. Overall profitability had been on a downward trend as costs continued to increase, and they had little ability to raise global prices. Additional operations in these newly developing countries meant more independent product entities that would be challenged with scale and efficiency.

Dynapac was also struggling to maintain their technology leadership position in the global market. New technologies in the area of electronic controls were ready to be implementation in both the compaction and paving products, but the company struggled to find the time and resources to make it happen. Other corporate issues including compliance to 2010 emission standards were also demanding the attention of the limited set of resources.

Summary

Dynapac’s Paving Equipment businesses faced a number of challenges, including lower profitability, increasing product variety, growing geographic reach, scale inefficiencies, decentralized product development and strong new emerging markets in Asia.

The company then implemented a modularity program that delivered significant results:

6% reduction in direct material cost

30% reduction in total part numbers

15% fewer parts per product

30% reduction in assembly time.

Dynapac established central product ownership; increased standard features, options and use of common parts; significantly reduced time to market for local product variants and faster quoting; and launched company-wide implementation of new technology for electronic vehicle controls.

Overall, the modular product architecture enabled global product platforms that boosted market share, not least in emerging regions.

CASE

Dynapac Story

Business Situation

Dynapac’s paving equipment faced a number of challenges, including lower profitability, increasing product variety, growing geographic reach, scale inefficiencies, decentralized product development, new emerging markets in Asia.

By 2005, the building of roads in China and other developing countries was the single, most significant market opportunity for Dynapac to grow sales of their products. Although local manufacturers could produce the same types of equipment, products from Dynapac and the other global competitors were more durable, produced a better road surface, and were more efficient. The lower cost of operation justified the purchase of the more expensive machines up to a price point that was slightly less than what could be supported in developed countries.

The challenge for Dynapac and its competitors was to produce products for these developing regions at the right price and performance level. To make a profit, they needed to manufacturer locally including the assembly of final products and the sourcing of components. Besides meeting cost targets, local operations were important for addressing local construction applications that required customization of the existing line of products.

This was not an easy proposition for Dynapac whose operations were already split between several independently-operating companies. Overall profitability had been on a downward trend as costs continued to increase, and they had little ability to raise global prices. Additional operations in these newly developing countries meant more independent product entities that would be challenged with scale and efficiency.

Dynapac was also struggling to maintain their technology leadership position in the global market. New technologies in the area of electronic controls were ready to be implementation in both the compaction and paving products, but the company struggled to find the time and resources to make it happen. Other corporate issues including compliance to 2010 emission standards were also demanding the attention of the limited set of resources.

Product Marketing & Management

Dynapac did not have a centralized understanding of the customers within all of the different markets and applications. Each of the regional groups that independently managed their local products and configurations had their own understandings. Without a global process or repository for these insights, it was difficult and time consuming to tackle company-wide product updates.

With the large volume of ideas for product improvements and unique applications in the various regions, each of the independent groups had a long queue of ideas for new product development. The development of these ideas, however, was intermixed with the delivery of custom product configurations to customers. Consequently, the primary source for new product variants within the various families was though customer projects. These new product variants would eventually be document and managed as part of the local product family.

Product Design & Engineering

The company was also organized with different design departments for each product line and regional resources to coordinate the quoting and manufacturing of custom configurations. Each department was skilled and experienced at independently running large, complex development projects. As a result, there was little sharing of resources and designs between these offices and across the various product lines. The same skills and responsibilities were repeated across each of the different group.

Dynapac was struggling to coordinate the whole company for large initiatives including the implementation of electronic vehicle controls (fly-by-wire). New technologies would normally develop within one of the independent product groups where they would eventually be integrated into a specific product during a larger vehicle development program. After completing the program, including the specific challenges for the initial vehicle, other product groups could work to integrate the technology into their products. Because of the independence of the groups and the singularity of product designs little efficiency was achieved with subsequent implementations.

Product Operations

Although they produced vehicle systems like automobiles, the requirements of the production systems were very different. The operations team at Dynapac was challenged with significant product variety and low volume of individual parts. They produced less than a thousand units of any one product variant in a given year. The team had started to look into Lean as a way to eliminate waste, improve efficiency and reduce costs, but they generated only limited success.

The actions to improve efficiency and reduce cost would have to be their own unique solutions. “We had a lot of parts with low volume, and the product cost was increasing,” says Bo Svensson, Project Manager at Dynapac. This led to low cost-efficiency, long lead-times and affected the company’s overall competitiveness and profitability.

Goals for the Product Architecture

To effectively follow the market opportunity into emerging regions, the management team at Dynapac decided to find a different approach to managing and delivering their products. The decentralized approach was generating decreasing levels of profitability as it was scaled-up to support increasing product variety and geographic reach. They needed new products quickly and a way to efficiently and affordably add new technologies to maintain their leadership position.

They sought to globalize product platforms to gain efficiency and simultaneously increase the overall assortment and local coverage. After some investigation, Dynapac concluded that the underlying structure for these platforms needed to be based on a Modular Architecture. “We had investigated different solutions”, says Svensson. “But we also knew that Scania (one of the world’s largest truck, bus and motor manufacturers) was using modularization as a leading system. That was the main reason we went to Modular Management.”

To achieve widespread product and organizational changes, Dynapac initiated a number of projects that began soon after one another. The stagger of projects helped them to take advantage of the learnings from one project just ahead of another. The first project was for tandem asphalt rollers in the 7 to 13 ton range. Larger rollers were followed by smaller sizes.

Revenue Growth

By combining the significant market opportunity in emerging regions of the world and a systematic approach to their product operations, Dynapac expected to increase gross profits by 17%. Modular Architecture would enable the development of a world product platform that could efficiently deliver the range of product needed to satisfy customers in both developing and in developed countries.

The Modular Architecture approach would also enable up to a 50% reduction in time to market for new product variants. This meant more time and resources to modernize the various vehicle platforms and to develop lower priced variants for emerging markets. By isolating key systems and features within modules, an updated version can be added without disrupting the design of the rest of the vehicle.

By offering a larger range of standard features and options and by reusing the majority of modules in custom products, Dynapac expected to reduce the average time to quote a custom product configuration by 50%. This will get product to customer quicker and it will free-up resources to work on new product development.

Profitability Improvement

Dynapac predicted that increased revenue alone was not enough to meet their profitability targets. Therefore, they also looked for ways to improve the efficiency of their operations and reduce costs. By analyzing both direct and indirect costs, they found opportunities to reduce their total cost basis by 9%. The largest portion, 5%, was coming from efficiency gains in the value added operations. An additional 3% were indirect cost reductions that would come by working with fewer suppliers. The final 1% is a reduction in capital costs coming from better utilization of tooling.

“It was a very deep pre-study,” says Svensson. “The results showed we should make more money. We could save a lot on indirect costs … reduce the number of parts … and be more effective in updating machines.”

For tandem asphalt rollers, the world product platform approach with Modular Architecture would reduce the number of unique part numbers by 40%, and the higher volumes of components would reduce material costs by 5%. Individual vehicle systems could also become more efficiency using 30% fewer parts and requiring 25% less assembly time.

Business Results

By 2007, Dynapac had transformed the first of the tandem asphalt rollers and was well on their way to completing the rest of the product category. They now had a global platform and family approach that has greatly improved their efficiency and reduced product costs. Products are managed on a global scale in order to reuse designs and to use common components, but they have the flexibility to adapt to local applications. Dynapac has been able to effectively address the market opportunity in emerging countries with the right product at the right price.

They are creating more new products with the same product development resources. Future products are designed in parallel from the same platform reusing many of the same modules. In fact, the primary design efforts have been shifted from developing completely new products to developing of new modules. Additionally, new CAD/CAM support systems, product configurations, marketing materials and manuals are all based on the Modular Architecture and are making a more efficient organization.

“If you’re interested in or thinking about using modular systems, then Modular Management is the right company,” says Svensson. “We see they have the right knowledge to put the modular systems into place. Their consultants worked in a professional way; they have a lot of experience. They were very, very good.”

Product Marketing & Management

Dynapac greatly increased the number of standard features and options offered to their asphalt rolling customers. These product variants are configured directly from the global platform without the need to make local engineering changes. They are using a configuration software tool to coordinate selling and manufacturing of the vehicle systems which is helping to reduce order-to-delivery time.

To begin the development of the Modular Architecture, Dynapac completed 75 in-depth interviews with customers around the world. The knowledge gained in the analysis of the interview data allowed them to define and map-out the scope of regions, application and customer needs that would be targeted with the global product family.

Product Development & Engineering

The engineering and design organization at Dynapac changed drastically during the process of developing a Modular Architecture for their roller products. A single development organization now handles the roller product family in one, centralized location. In the past, responsibility was spread out over several product organizations where they would adapt the product design to local applications. This organization has also enabled a tighter coupling with the marketing team improving planning and prioritization of development activities.

The new centralized product family had a large impact on the number of parts needed to support all of the different product variants. The number of unique parts for the product line was reduced by 30% and will continue to decrease. Also in 2007, the parts per product were reduced by 15% and expected to decrease even further.

Determining the product architecture before any detailed design work allowed the team to accommodate and plan for major technology introductions across multiple product families. For electronic vehicle controls, Dynapac isolated the impact of the technology change to a few modules with well-defined, standardized interfaces. At the same time, they were able to take into consideration other vehicle platforms when making major design decisions. Modules not affected by the technology change could be simultaneously developed, and everything could be integrated together later in the project.

Product Operations

Dynapac operations were greatly improved with the implementation of the Modular Product Architecture. Operations became much more uniform around the world, and the teams could share experiences and improvement initiatives. Modules were now being built and tested upfront before they were assembled into the vehicle, and the overall assembly time was reduced by 30%. They are also attacking problems and issues in smaller, more manageable chunks.

Dynapac also involved their suppliers early in the design process. Several key modules including the engine, cab, hydraulic and electrical subsystems were setup to take full advantage of the architecture. By reusing modules across the different sizes or rollers and across the world, they were able to reduce material cost by 6%.

Modular Architecture in Action

During the development of the Modular Architecture, the team at Dynapac spent a lot of time understanding customer needs and how they align with the physical properties and performance of their products. One of the big discoveries they made was how important the human interaction with the vehicle was to the safety and efficiency of the machine.

Through the analysis of the relationships between customer value and product functionality within the Modular Architecture, Dynapac discovered that driver visibility was a key attribute of the product. This discovery reprioritized many of their design efforts to deliver a higher level of performance for this property. They paid special attention to the size and placement of the windows and the location of the cab relative to the working components.